Manufacturing Sector: Unit Labor Cost (ULCMFG) | FRED | St ...

Nov 06, 2019· Graph and download economic data for Manufacturing Sector: Unit Labor Cost (ULCMFG) from Q1 1987 to Q3 2019 about unit labor cost, sector, manufacturing, and USA.

WhatsApp)

WhatsApp)

Nov 06, 2019· Graph and download economic data for Manufacturing Sector: Unit Labor Cost (ULCMFG) from Q1 1987 to Q3 2019 about unit labor cost, sector, manufacturing, and USA.

The cost of goods manufactured is a calculation of the production costs of the goods that were completed during an accounting period. In other words, it includes the costs of direct materials, direct labor, and manufacturing overhead that are included in the products that moved from the ...

3 Imperial Jewelers manufactures and sells a gold bracelet for The company''s accounting system says that the unit product cost for this bracelet is as shown below Direct materials Direct labor Manufacturing overhead unit product cost 141 89 35 265 points eBook The members of a wedding party have approached Imperial Jewelers about buying 24 of these gold bracelets for the ...

As inventory items are sold and/or used in the production process the cost of the sale/WIP (Work In Progress) assigned to the transaction is derived from the number of items from an inventory layer multiplied by the unit price of the inventory layer needed to satisfy the sale/manufacturing .

Jun 01, 2017· LED Bulb Manufacturing Machine and its cost Khademul Basar ... How To Recover Gold From Computer Scrap with ... Electric Motor HOW IT''S MADESuper Electric Motor Manufacturing Technology in ...

3 Imperial Jewelers manufactures and sells a gold bracelet for The company''s accounting system says that the unit product cost for this bracelet is as shown below Direct materials Direct labor Manufacturing overhead unit product cost 141 89 35 265 points eBook The members of a wedding party have approached Imperial Jewelers about buying 24 of these gold .

Machinery cost The manufacturing unit should be equipped with a strong integrated production system, with a wide range of rugged high speed automatic machines to achieve high levels of accuracy and consistency. Says D D Sharma, CEO, FluidoMatic, a maker of battery manufacturing machinery, "We have solutions for all types of battery machines ...

Question: Imperial Jewelers Manufactures And Sells A Gold Bracelet For The Company''s Accounting System Says That The Unit Product Cost For This Bracelet Is As Shown Below: Direct Materials 147 Direct Labor 85 Manufacturing Overhead 36 Unit Product Cost 268 The Members Of A Wedding Party Have Approached Imperial Jewelers About Buying 21 ...

Manufacturing unit costs. Your business needs. In almost any business planning process, there needs to be a mechanism that offsets margin erosion – and if it is not revenue growth or portfolio expansion, then it has to be cost reduction. Most of the STC (Short Term Controllable) costs are associated with the manufacturing unit cost, which is ...

Get updated data about gold, silver and other metals prices. Find gold, silver, and copper futures and spot prices.

pure gold may be applied over bright nickel and this can be more economic where wear resistance is required watch cases, pen cases, plumbing fixtures and door handles and hinges. In all these decorative uses, the colour of the gold is a very important feature ranging from white gold, yellow to rose, red

Product cost consists of two distinct components: fixed manufacturing costs and variable manufacturing costs. The production capacity refers to the people and physical resources needed to manufacture products — these are fixed manufacturing costs. In the image below, note that the company''s variable manufacturing costs are 410 per unit, and its fixed manufacturing costs are [.]

Cost of case divided by number of units. For example you bought a dozen eggs for 24.. what is the unit price per egg? 24 / 12 = 2 per egg. or say you are calculating the cost of manufacturing ...

The three major cost components of manufacturing a product are:Product costs, period costs, and variable costs.Marketing, selling, and administrative costs. ... All raw materials used were traceable to specific units of product. Healey Company''s direct materials used for .

In a manufacturing company, you will have a budget for all of your manufacturing costs including Direct Materials, Direct Labor and Overhead. ... In a materials budget, we will deal with units first and then add the budgeted cost near the end. We also need to know how many direct materials are needed for each unit.

Total Manufacturing Cost. In order to determine per unit cost of a product, you have to first calculate the total manufacturing cost of all the items manufactured during the given period. Then, divide the calculated value by the number of the items. The end figure you obtain is one unit''s manufacturing cost.

Jun 20, 2014· Costs can be split up into manufacturing and nonmanufacturing costs. We''ll look over certain direct and indirect costs and decide how they should be categorized.

Question: Imperial Jewelers Manufactures And Sells A Gold Bracelet For The Company''s Accounting System Says That The Unit Product Cost For This Bracelet Is As Shown Below: Direct Materials 147 Direct Labor 85 Manufacturing Overhead 36 Unit Product Cost 268 The Members Of A Wedding Party Have Approached Imperial Jewelers About .

SP Enterprises sold 10,000 units of inventory during a given period. The level of inventory of the manufactured oviduct remained unchanged. The manufacturing costs were as follows: Unit manufacturing cost of the period (V) (F) Unit operating expenses of the period (V) (F) Which of the following statements is true?

I think solar panel manufacturing is tough in of environmental conditions and lack of technical knowledge about it. Here people are only doing assembling of solar cells to make solar panels. We need lot of research to setup all thing...

The gold prices used in this table and chart are supplied by BullionDesk. Where the gold price is presented in currencies other than the US dollar, it is converted into the local currency unit using the foreign exchange rate at the time (or as close to as possible).

The direct production cost per unit of a product usually consists of the following: direct materials, variable manufacturing overheads, and direct labour. Table no. 1 . The basic model for calculating the cost of production under direct costing . Variable (direct) costs Variable manufacturing overhead Total variable costs . 1.

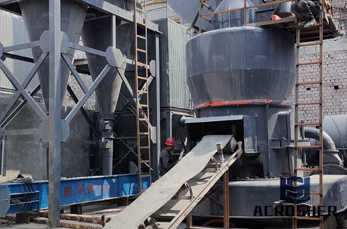

Setting up a manufacturing unit is almost like building your house, and if you are a first generation entrepreneur, it is going to be a truly challenging and equally intense learning process. Manufacturing processes come in all shapes and sizes and require a substantial commitment.

You have 19,500 in cost of goods sold, an amount that goes right to the income statement. To figure out the cost per unit, divide the total cost by the 4,200 units sold: (19,500 ÷ 4,200 gallons). As you may know from your financial accounting course, retailers use this same formula. Their inputs are purchases of merchandise.

WhatsApp)

WhatsApp)